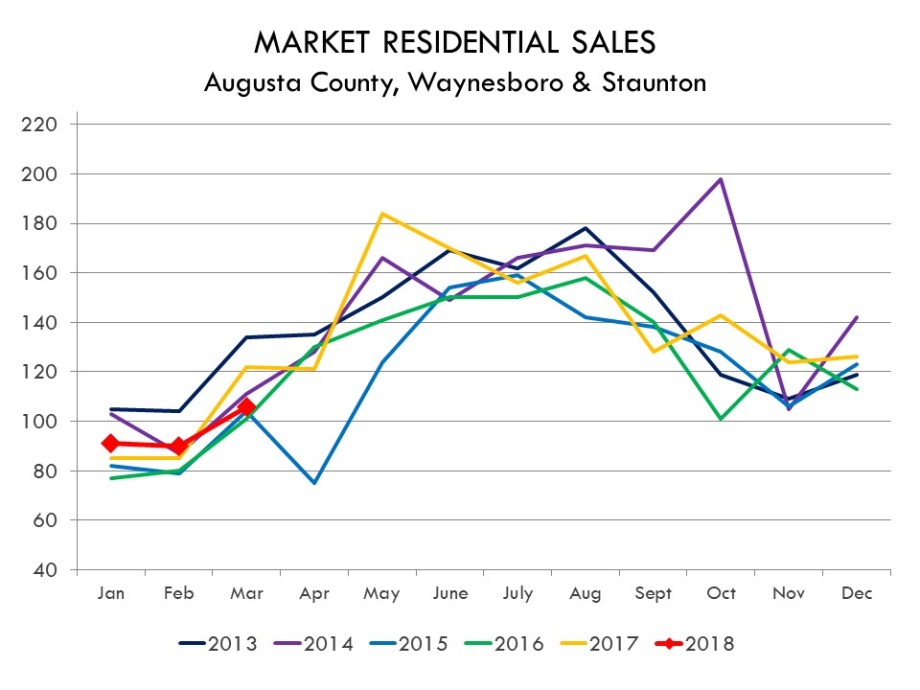

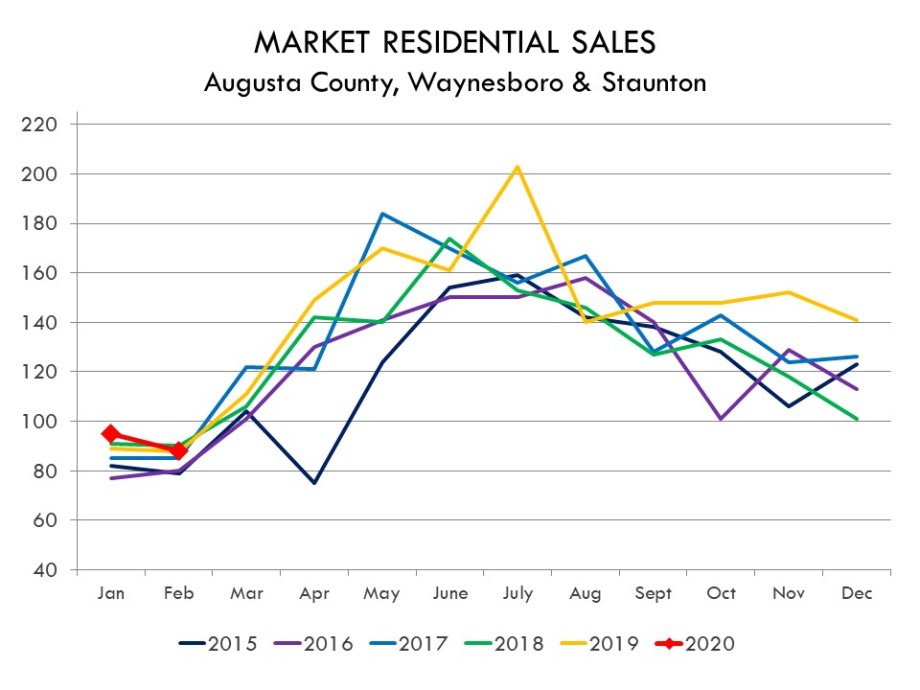

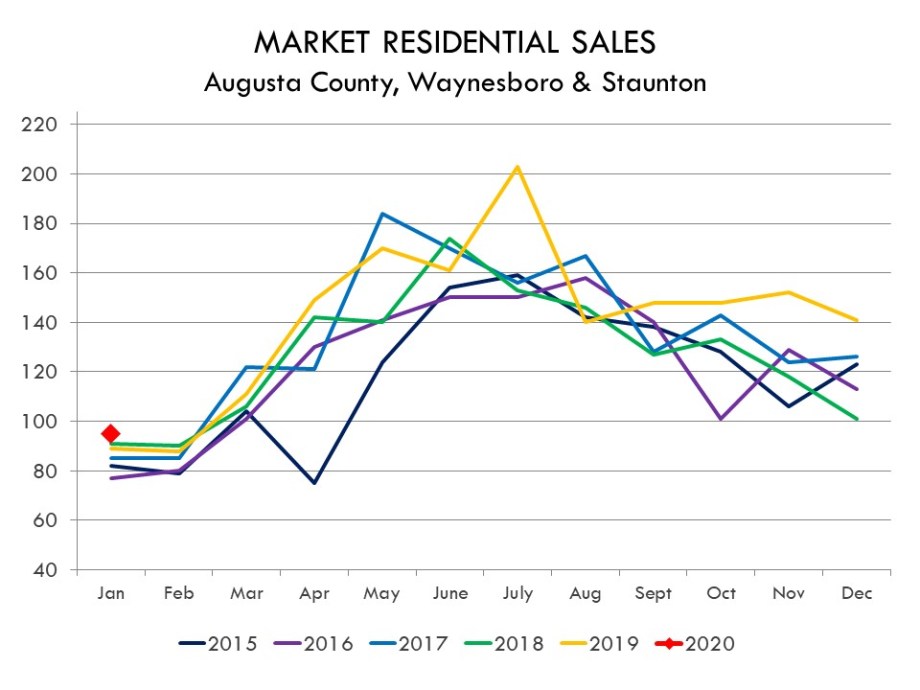

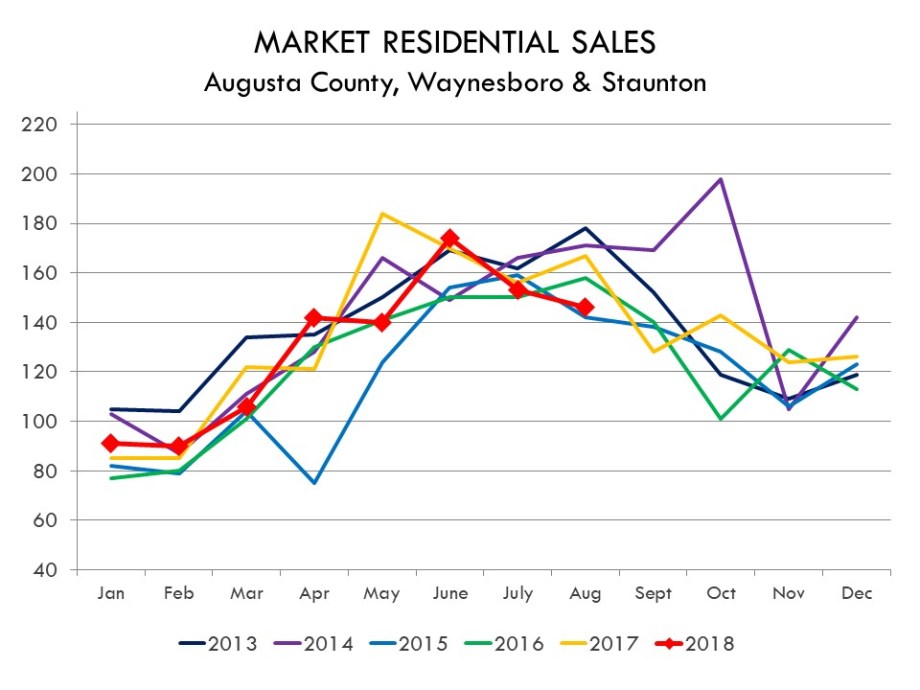

RESIDENTIAL SALES

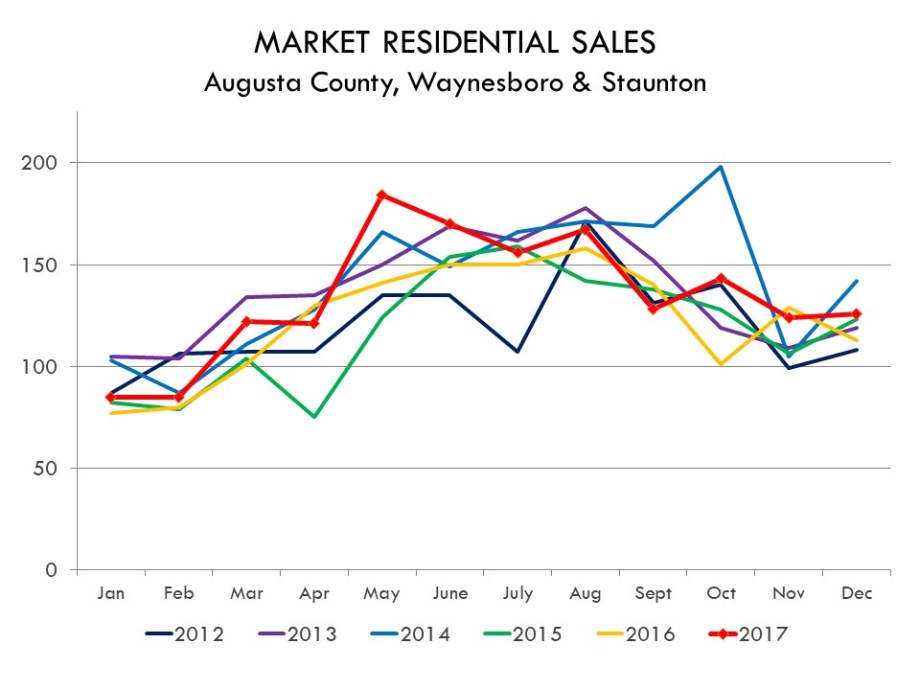

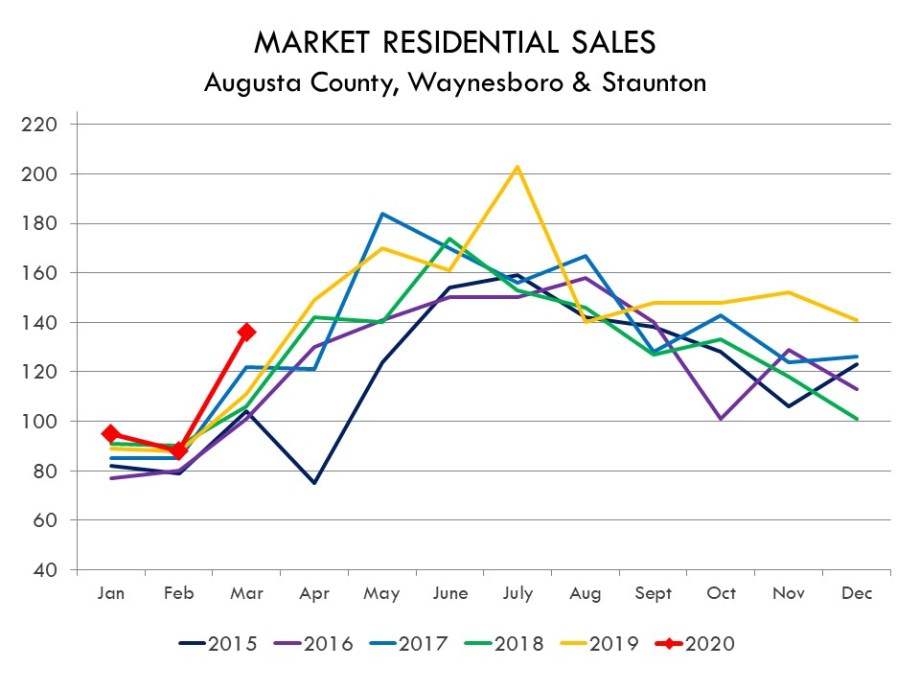

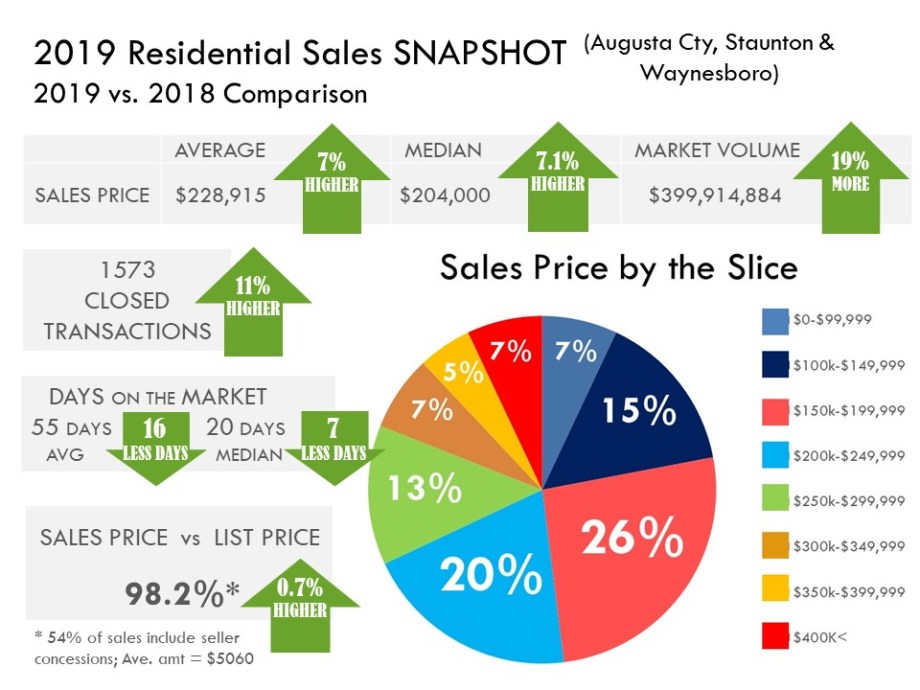

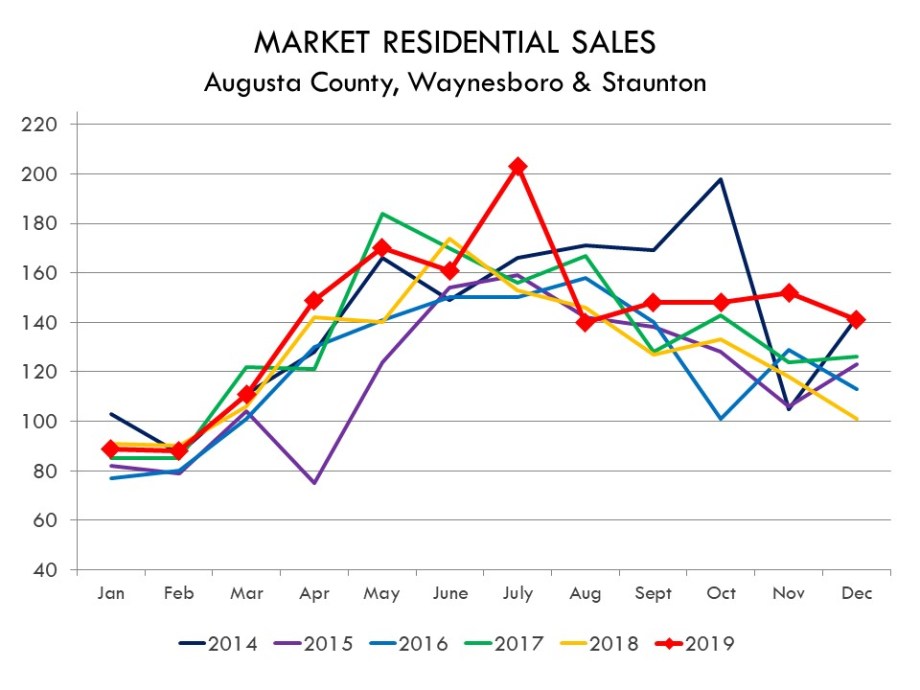

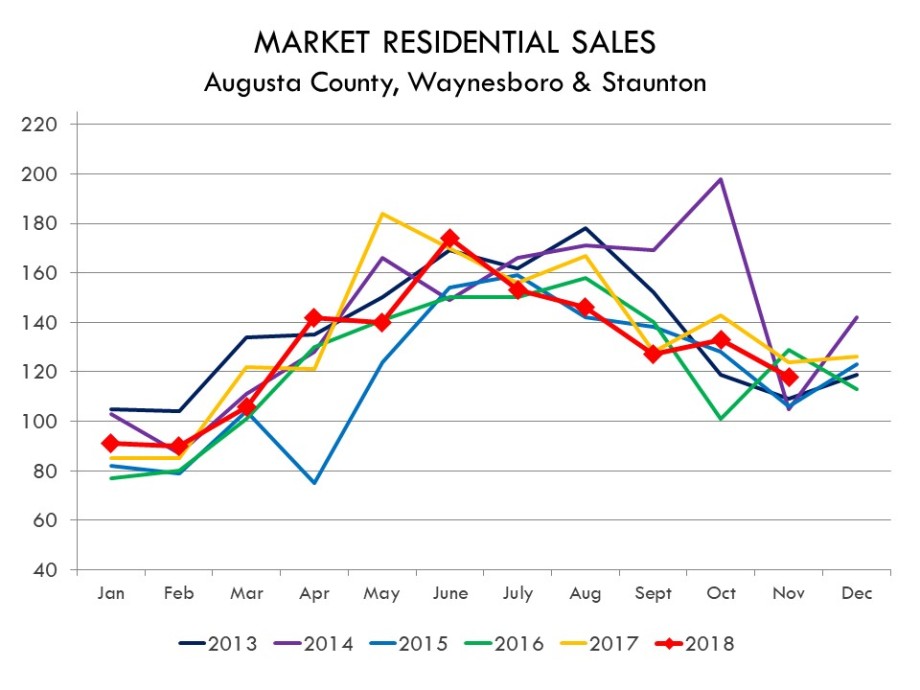

- The number of sales hit an all-time high in 2005, with a total of 1598 closed transactions and a low in 2010, with 935. the market has gradually improved since then…with 2019 surpassing 2005’s sales;

- 2015 = 1489 sales

- 2016 = 1511 sales

- 2017 = 1581 sales

- 2018 = 1573 sales

- 2019 = 1747 sales

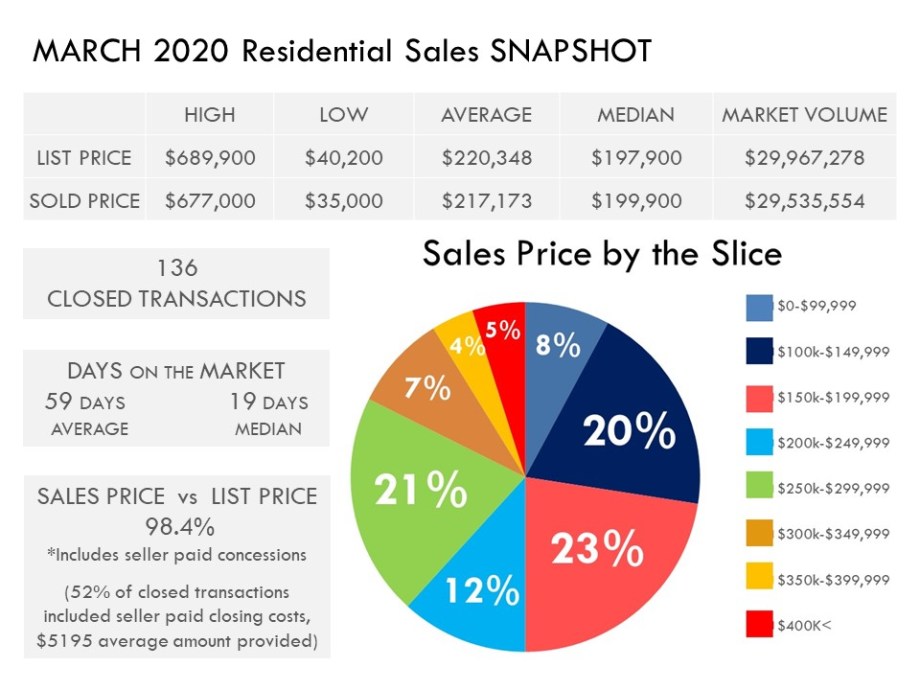

- 2020 ‘s Spring market started early and strong, with properties going under contract in Fred, resulting in a 5 year record breaking high in closed transactions. (FYI – Last year’s Spring market sales were strong in April; implying the initial buying process taking off in March.) Mar ’20 (136) is 22.5% INCREASE when compared to last Mar ’19 (111).

- Mar 2020 12 Mo. Running Total (1892) displays a slight 2.6% INCREASE over last month’s total of (1844), and a 12% INCREASE from Mar 2019’s 12 Mo. Running Total (1687 sales). Mar 2020 YTD sales (324), is a 8.3% INCREASE from Mar 2019 YTD sales (299).

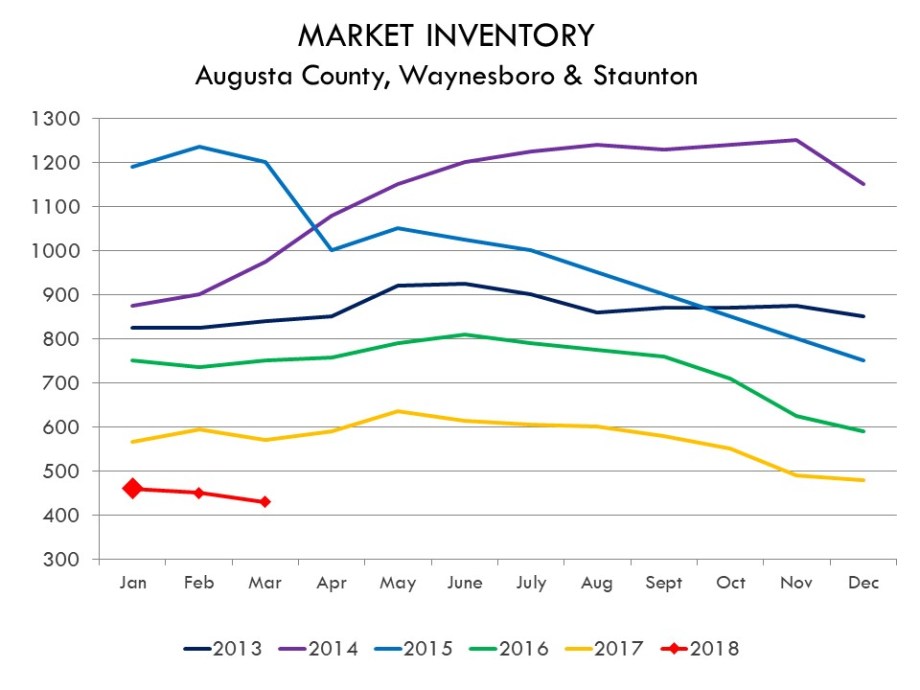

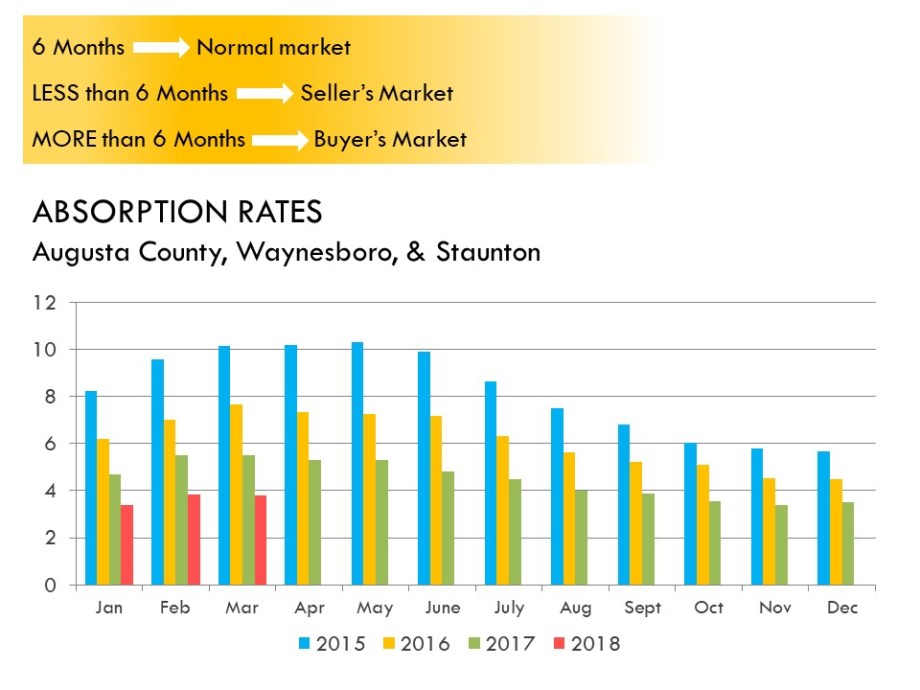

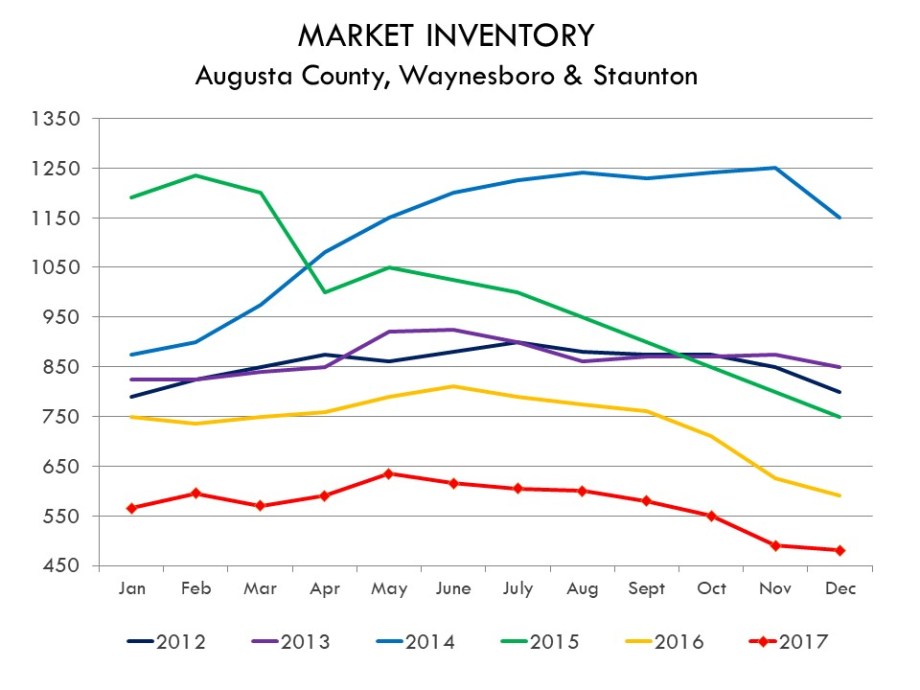

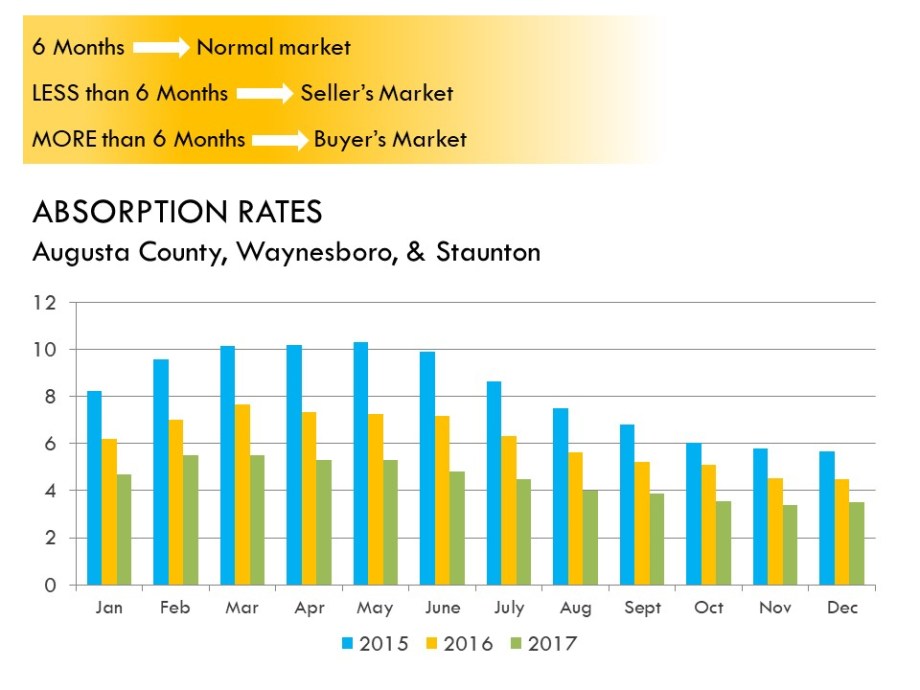

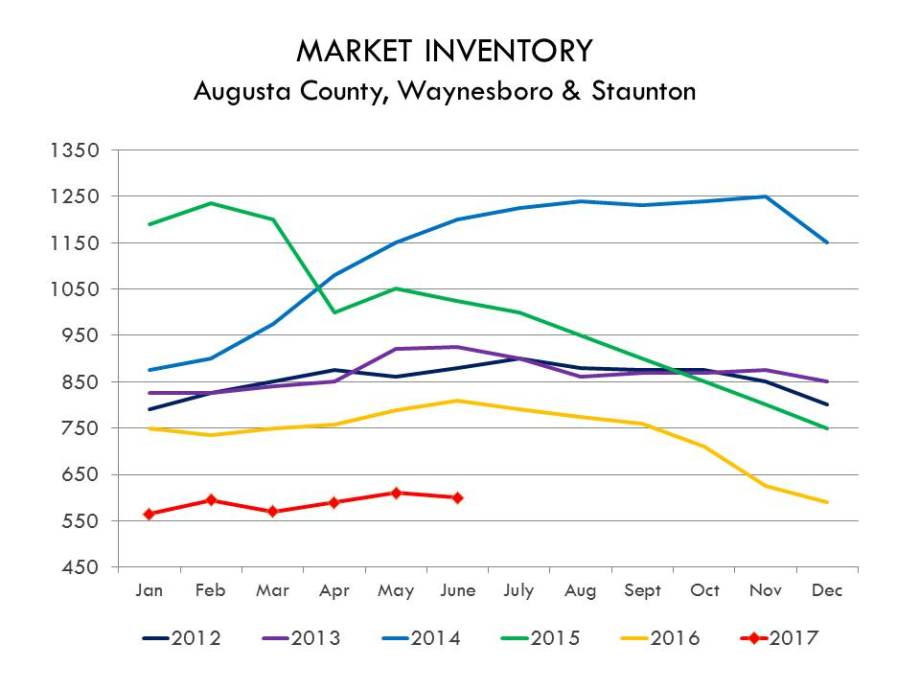

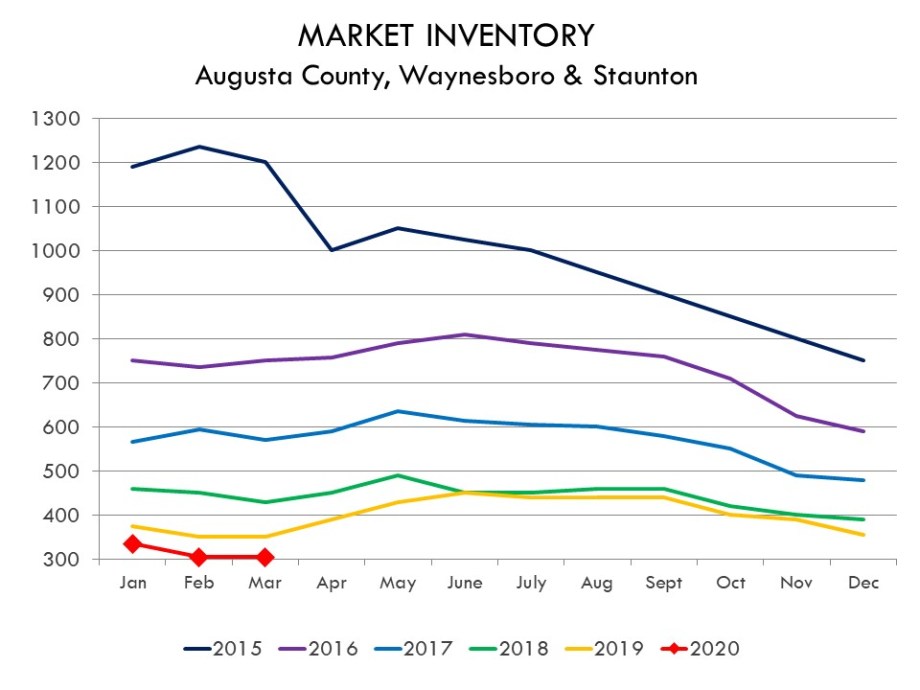

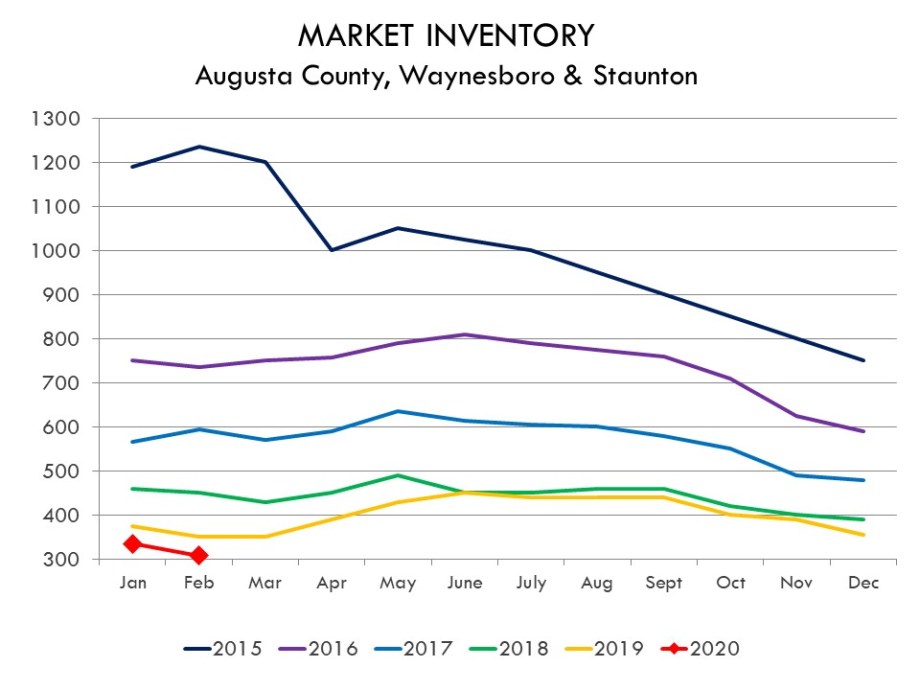

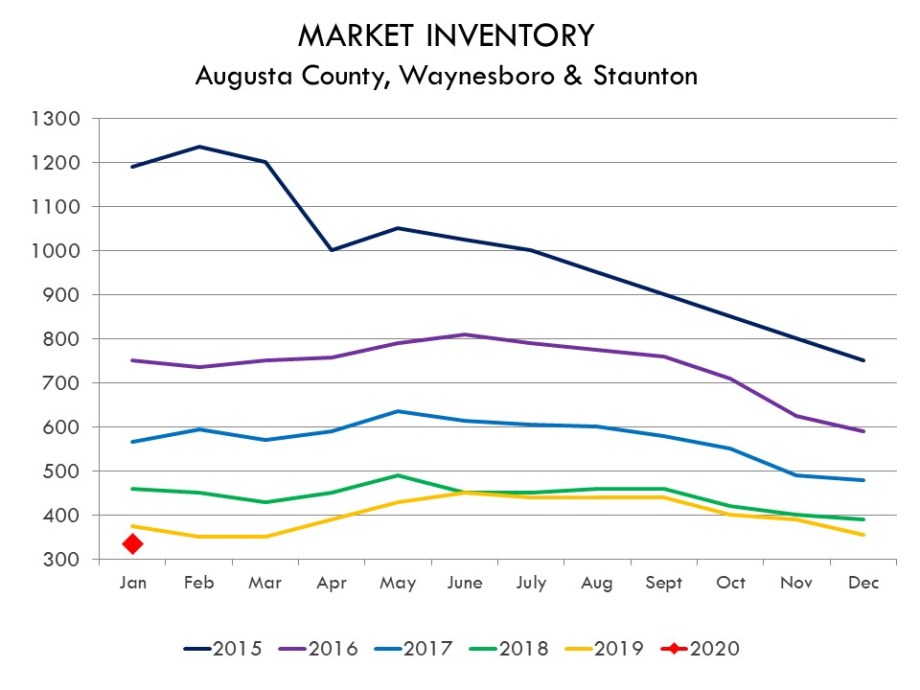

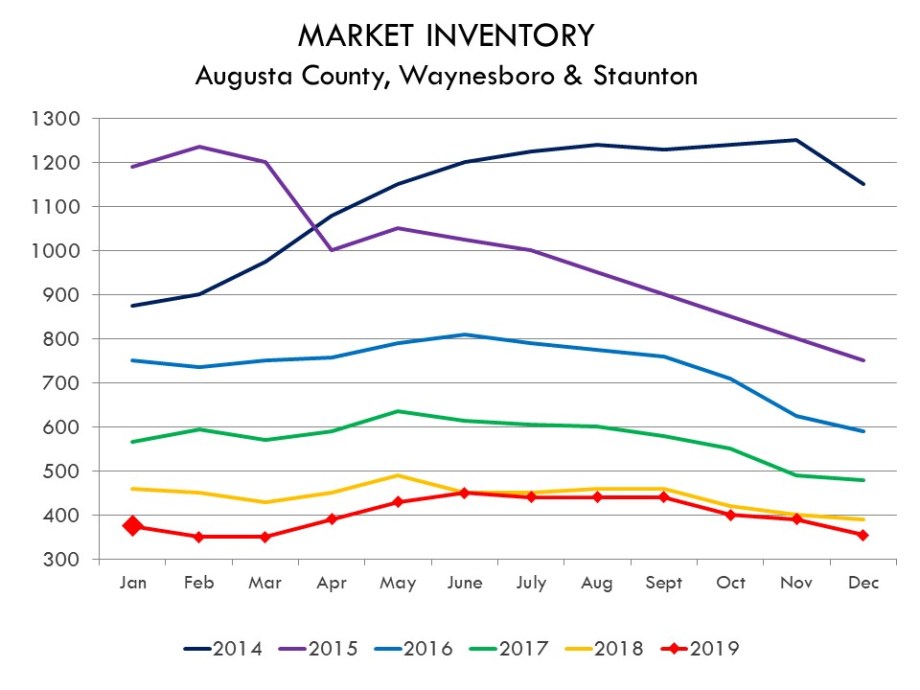

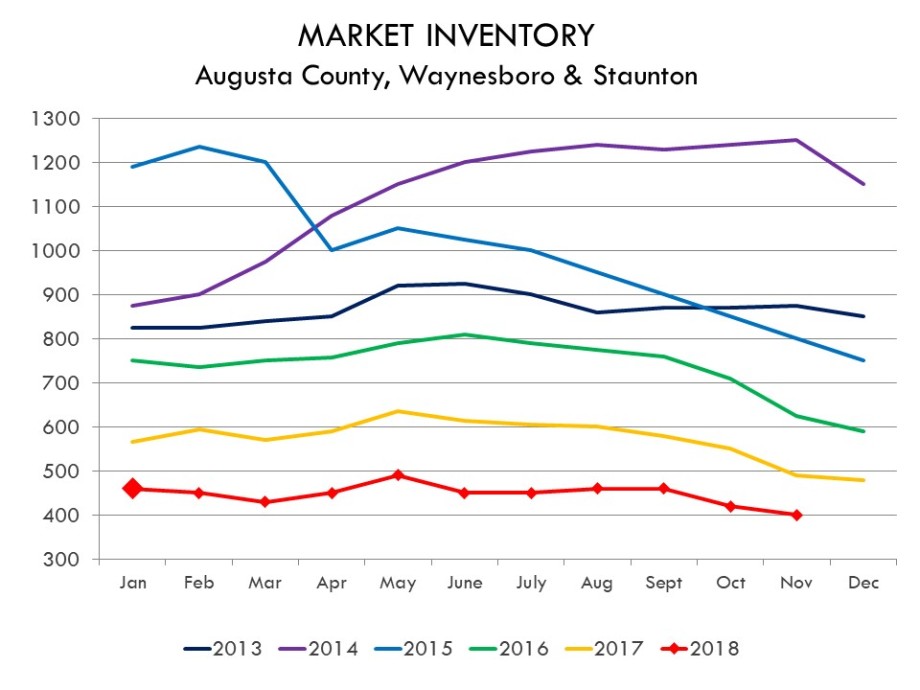

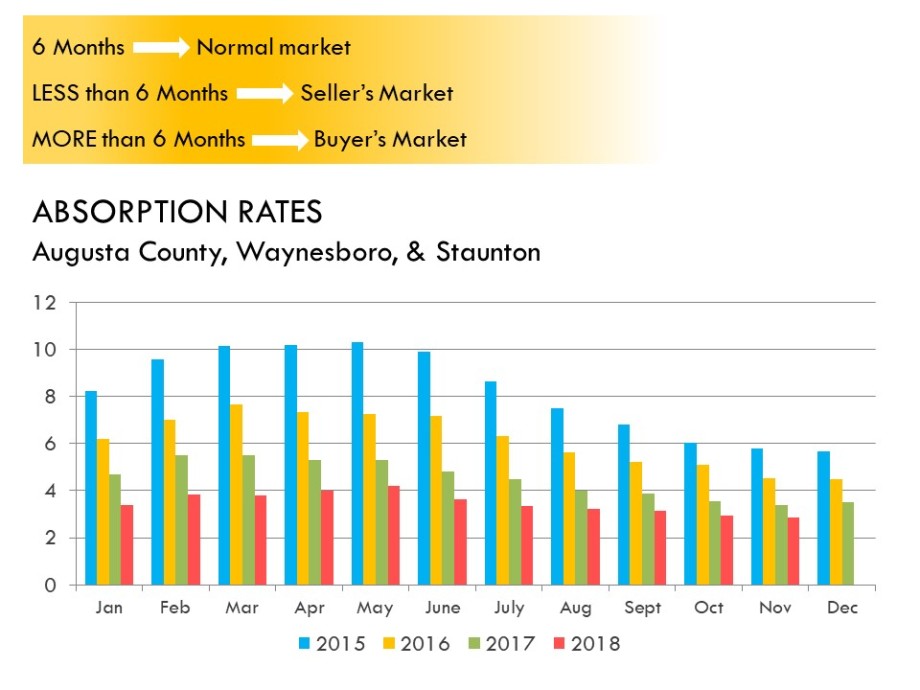

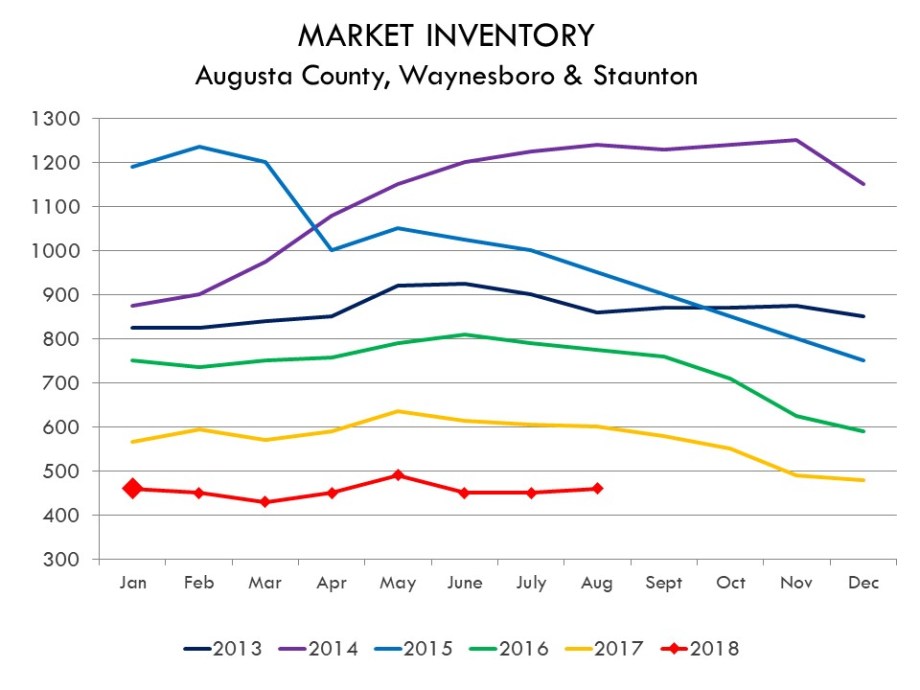

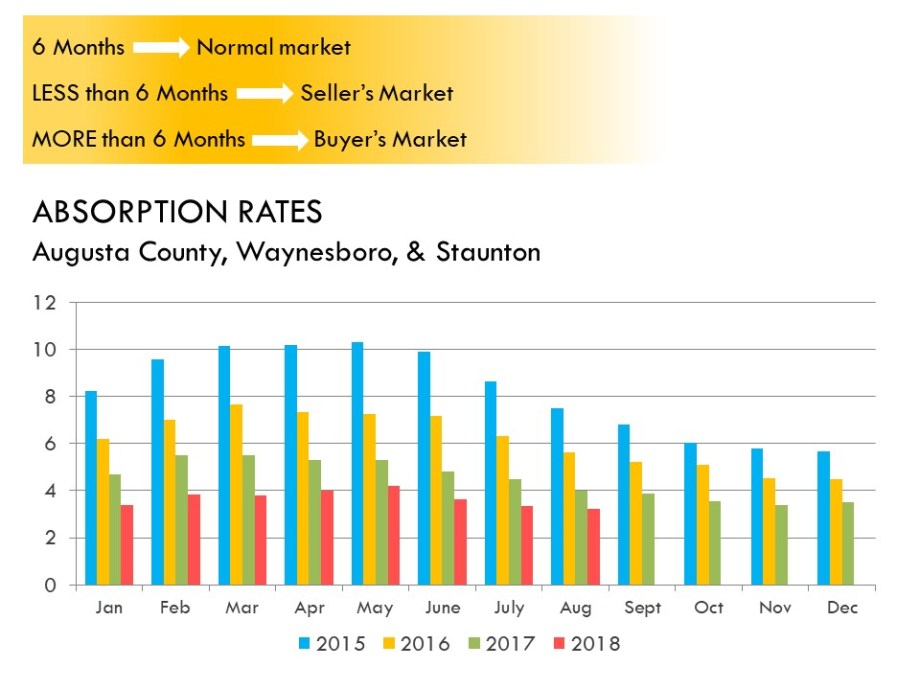

LOW HOUSING INVENTORY

How low can you go?…Historic lows in inventory began back in 2016, truly felt the impact during the 3Q 2016 buying season. the end of 2016 deemed itself a “price adjusting” year, cleaning out stale properties. since then, the inventory has continued to be squeezed, opening-up a tinie bitin the Spring market…but swallowed up quickly & further depleted until the end of each year. In 2020, our inventory is at its lowest with 305 active properties.

- Mar 2020 with 305 properties is a 13% < Mar 2019 (350) which is 29% < Mar 2018 (430) which is 47% < Mar 2017 (570) which is 59% < Mar 2016 (750).

*Historically, the increase in Spring inventory began in April, but in the current COVID19 pandemic, many homesellers are taking a “wait-and-see” stance. With less inventory available, we will see how that affects the amount of properties going Under Contract, therefore affecting the sales numbers moving forward.

**This could be even better news for Sellers placing their homes on the market…not so great for Buyers.

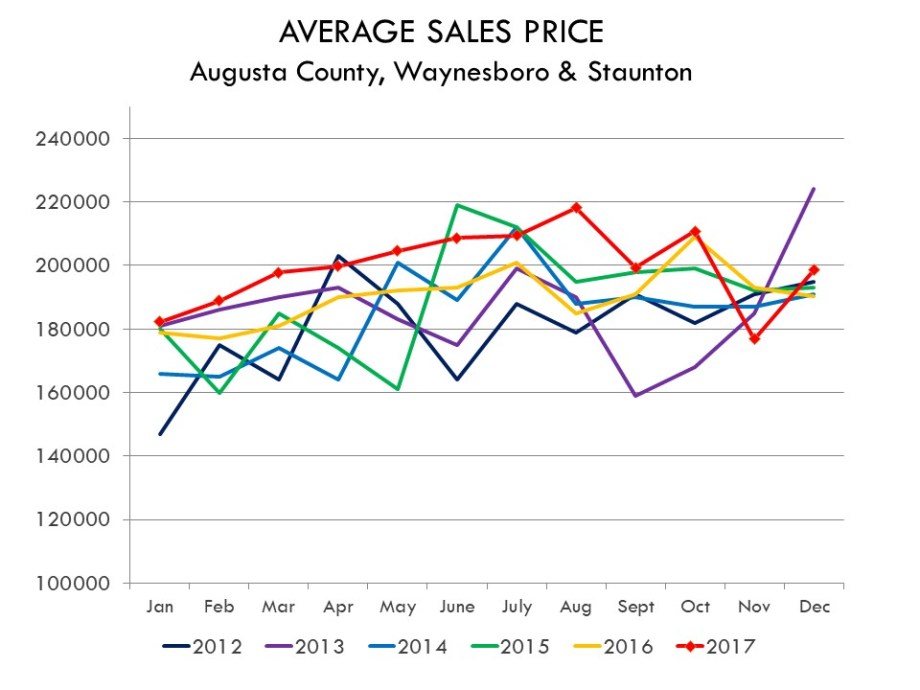

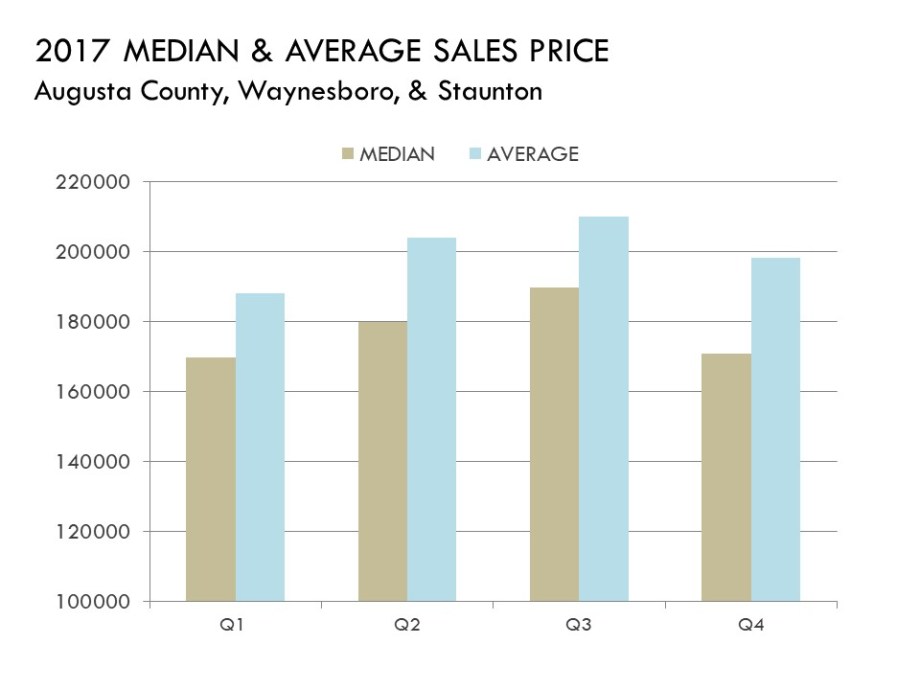

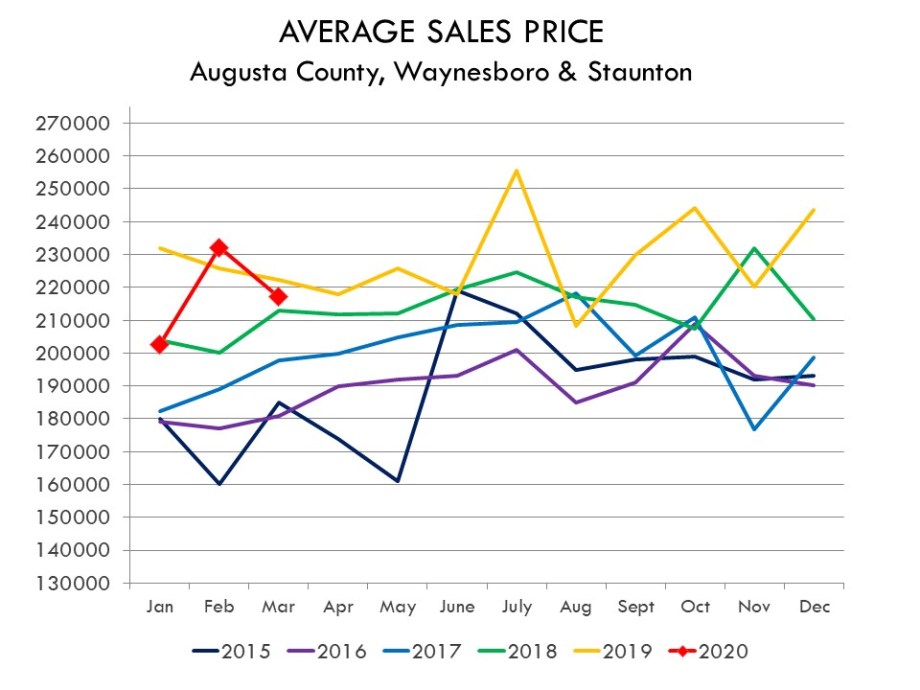

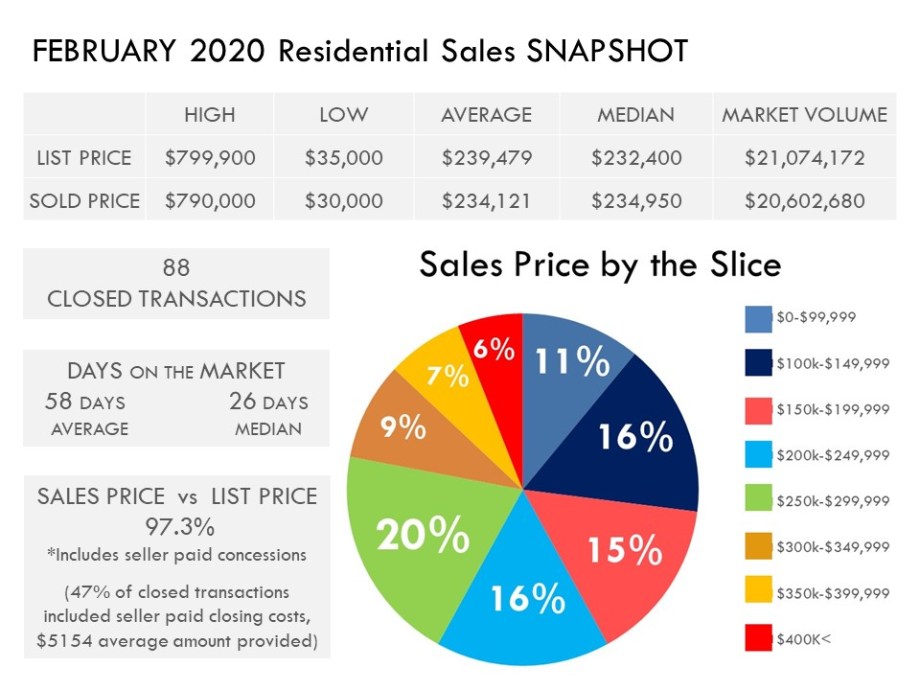

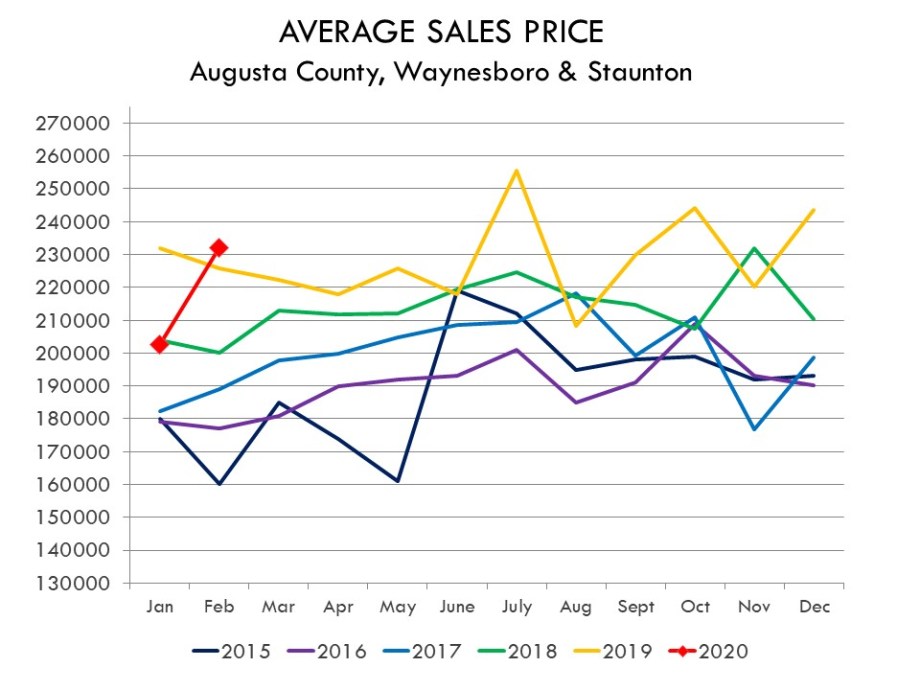

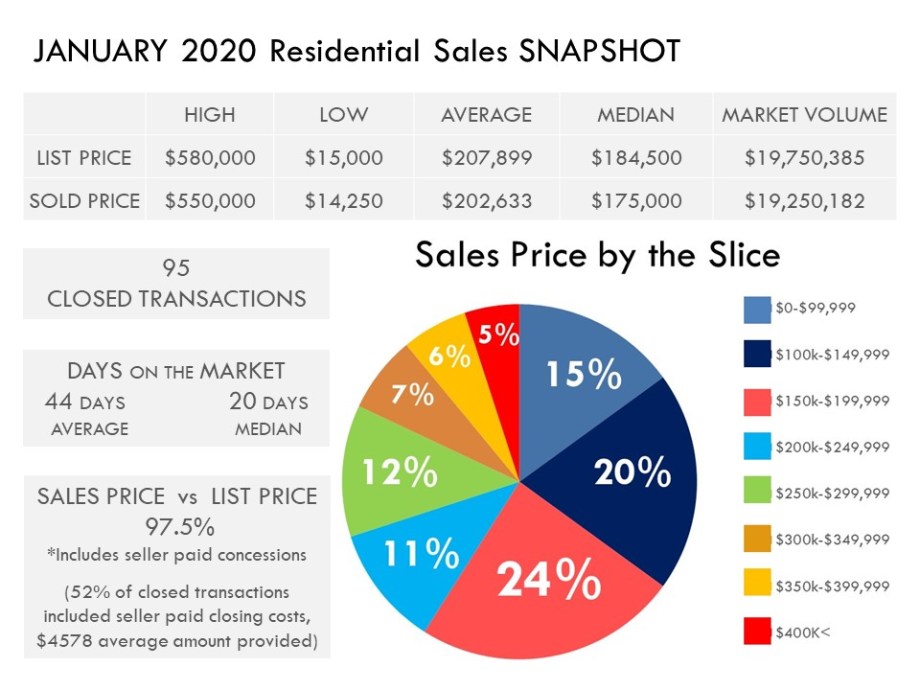

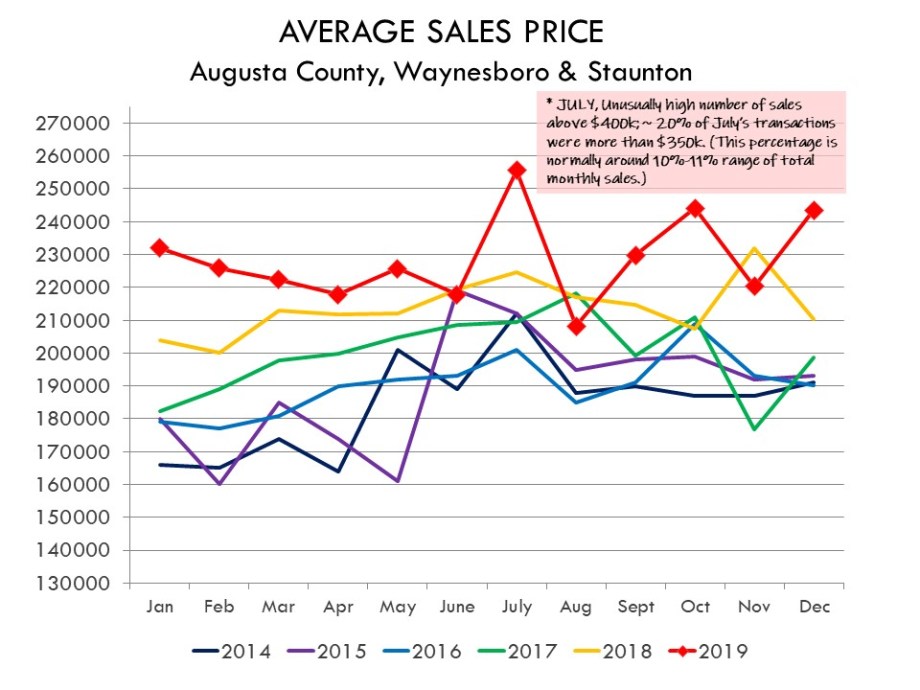

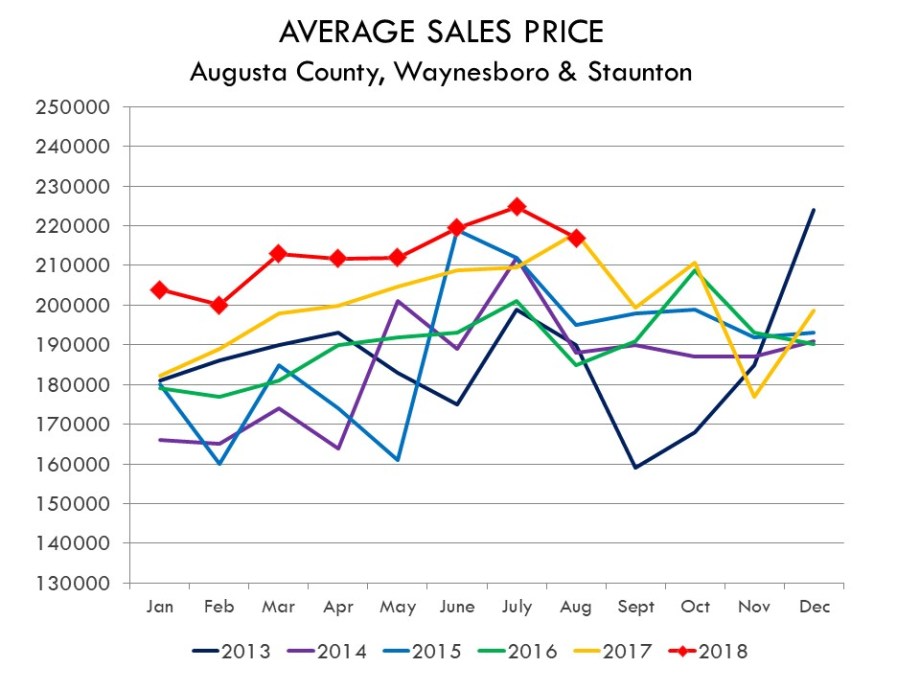

AVERAGE SALES PRICES

With low supply, comes high demand…reflected in the increase in Sales Prices. We noticed an average of 8% INCREASE over the course of last year, (varying higher/lower depending on the price bracket.) Mar 2020’s ASP ($217,173) is a 2.3% DECREASE from Mar 2019 ($222,352) and a 7.2% DECREASE from last month, Feb 2020 ($234,121). It has been somewhat of a “yo-yo” for last 6 months, so taking a look at the…

The 12 Month ASP is a more accurate predictor of sales trends. Mar ’20 12 Mo ASP ($226,843) displays a 4.3% INCREASE when compared to last year’s 12 Mo ASP ($217,491). This is more consistent with last month’s approximate year-over-year 12 Mo ASP’s 5% INCREASE. Overall, we have flattened out for the moment. The good news is that with the steady gains since 2016, many properties are back to their 2005-2007 market values.

Unfortunately, what is NOT factored into the average sales price, is the trend of Seller paid closing costs. 52% of March 2020’s sales included the Seller paying, on average, $5195 towards the Purchaser’s settlement fees at closing.

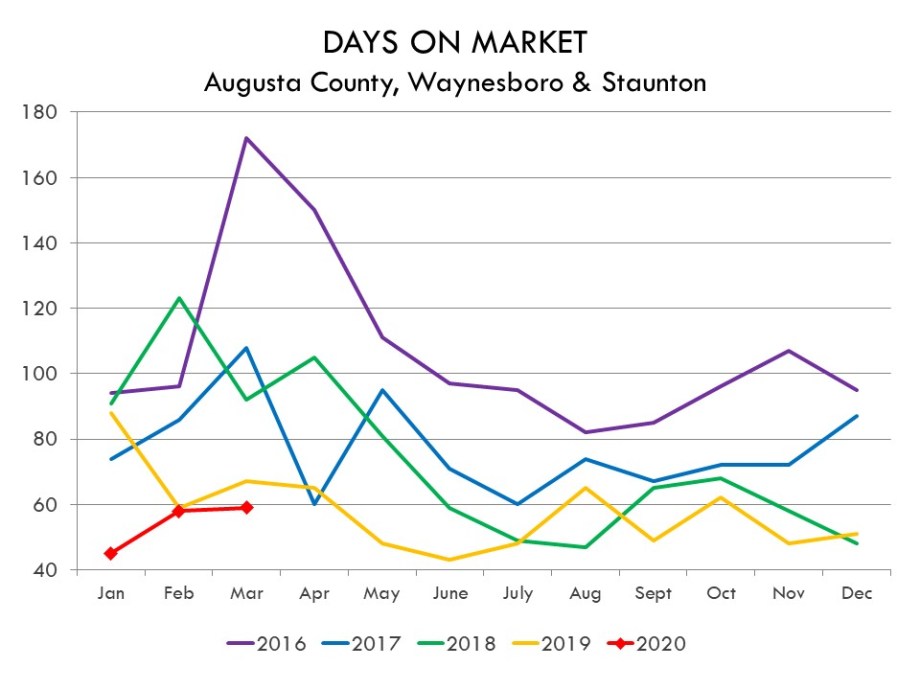

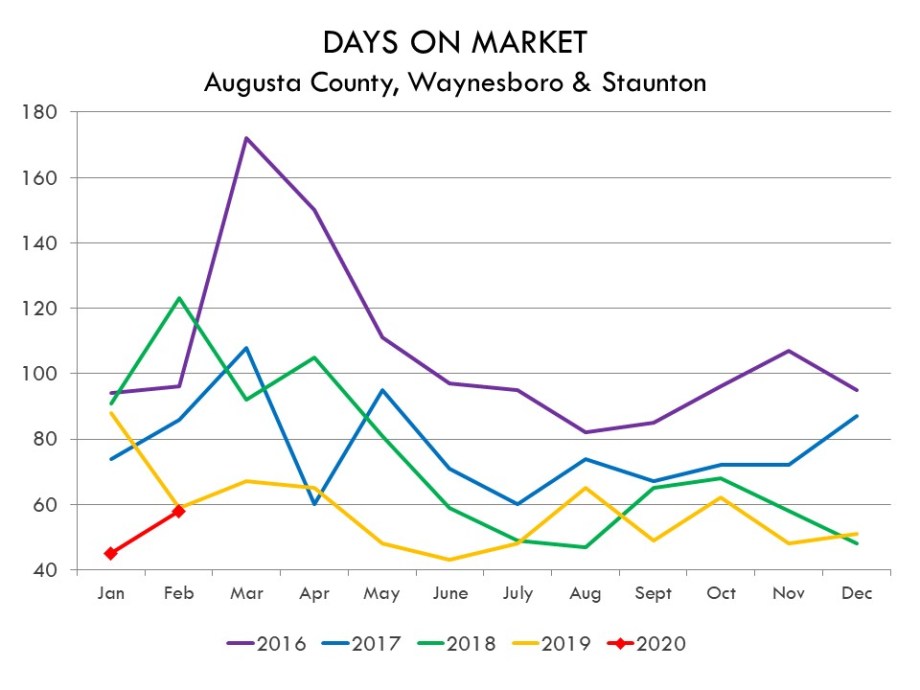

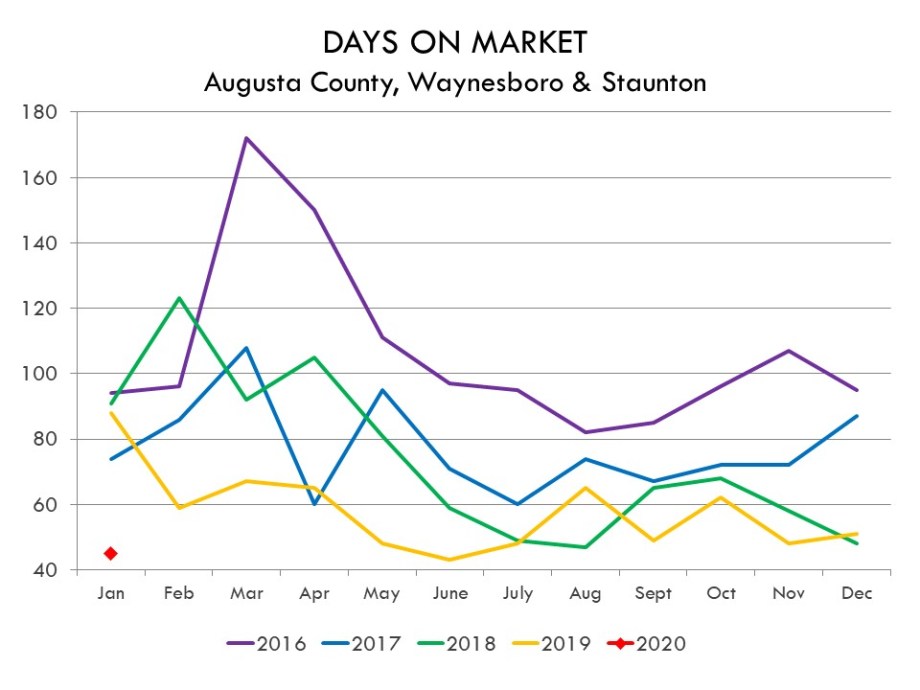

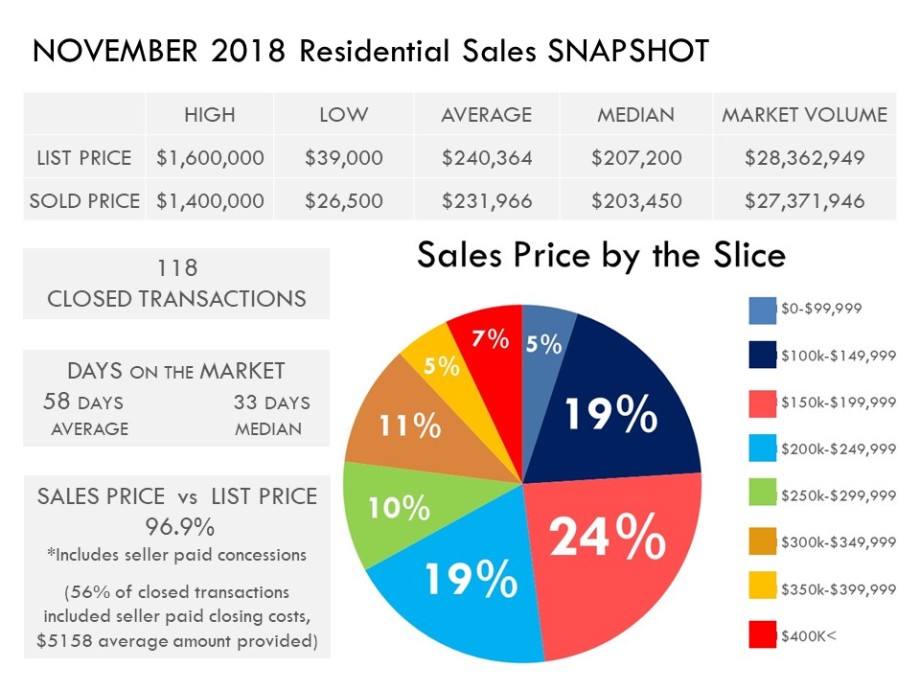

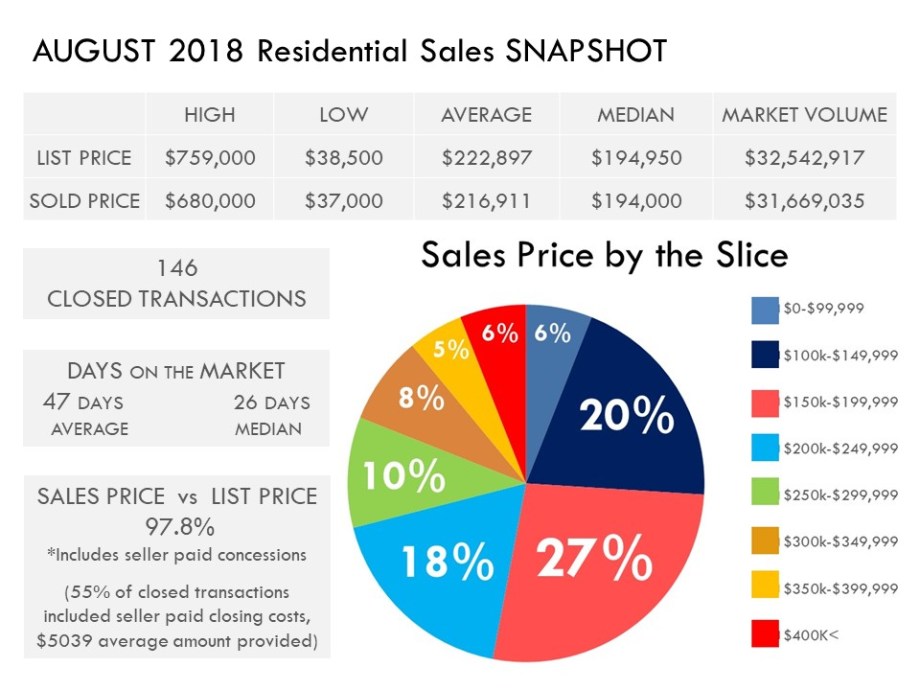

DAYS ON MARKET

Average Days on Market (DOM) for 2005 was 101 days. and steadily increased to an all time high of 177 days in April 2013. Low inventory has considerably dropped this number. 2019’s yearly average was 55 days, with a median DOM of 20 days. (* Normal Market is considered to be 90 days.)

- March 2020 STATS: Average 59 days / Median 19 days

- % of Mar Sales “Under Contract” within..

- 15 Days or less = 55%

- 30 Days or less = 65%

- 45 Days or less = 69%

Interestingly, the available ACTIVE properties for Mar 2020 have been on the market 143 DOM. That’s 84 more days than the SOLD DOM for the month. Indicating, that most properties properly priced are moving quickly, while the others are sitting on the market getting stale.

Have further questions not mentioned in this post? Feel free to give me a jingle! Until April’s update…Take care & stay safe out there!

[The information presented is deemed accurate, but not guaranteed. Data sourced from the Greater Augusta Association of REALTORS (GAAR) for Residential, Single Family homes in Augusta County, Waynesboro & Staunton Virginia; YTD 2020.]

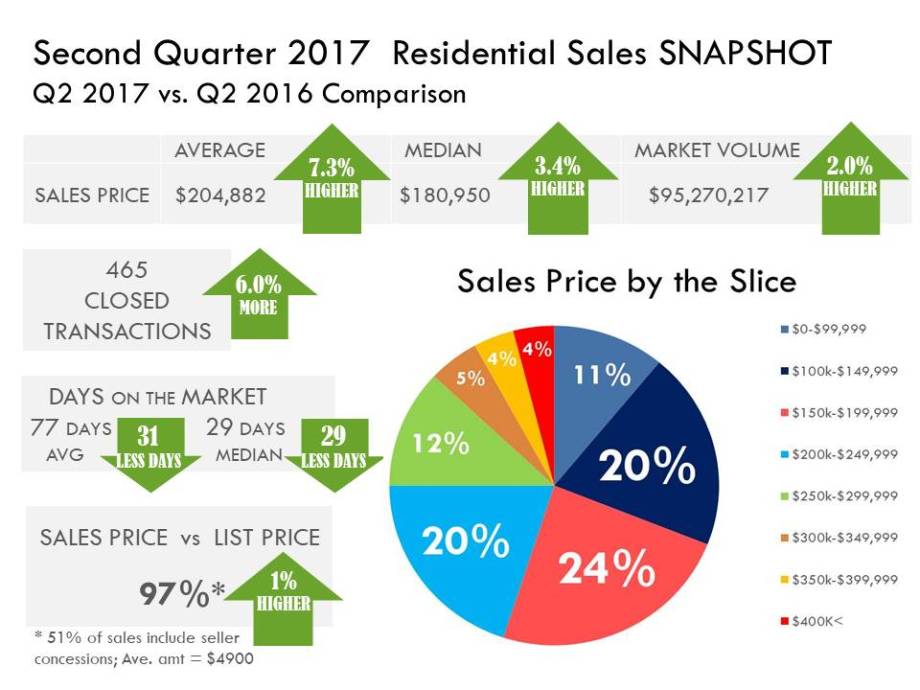

rage of 77 Days.

rage of 77 Days.

Average Days on Market (DOM) for 2005 was 101 Days, and steadily increased to an all-time high of 177 days in April 2013.

Average Days on Market (DOM) for 2005 was 101 Days, and steadily increased to an all-time high of 177 days in April 2013.